Representative example, credit amount € 1.500, variable annual nominal interest rate 17,50% (interest rates act reference rate 2,50% + 15,00% margin), APR 18,97%. Payback in 12 equal monthly installments € 137,16 Credit cost € 145,96, total amount payable € 1.645,96.

* Transaction fees may apply for additional services.

Fast

Apply today and receive your credit line offer in minutes, borrow up to €8,000 with no collateral or guarantors.

Convenient

Instantly transfer funds from your credit line to your daily bank account or spend directly from your Ferratum Mastercard at over 30 million merchants worldwide.

Compared to a bank loan

€0Average annual fee | €150Average annual fee |

MinutesActivation time | Up to 5 daysActivation time |

Up to 60 daysInterest-free period | Interest-free period |

Fraud protection | Fraud protection |

Worldwide access | Worldwide access |

Google Pay | Google Pay |

Apple Pay | Apple Pay |

Average annual fee | €150 | €0 |

Activation time | Up to 5 days | Minutes |

Interest-free period | Up to 60 days | |

Fraud protection | ||

Worldwide access | ||

Google Pay | ||

Apple Pay |

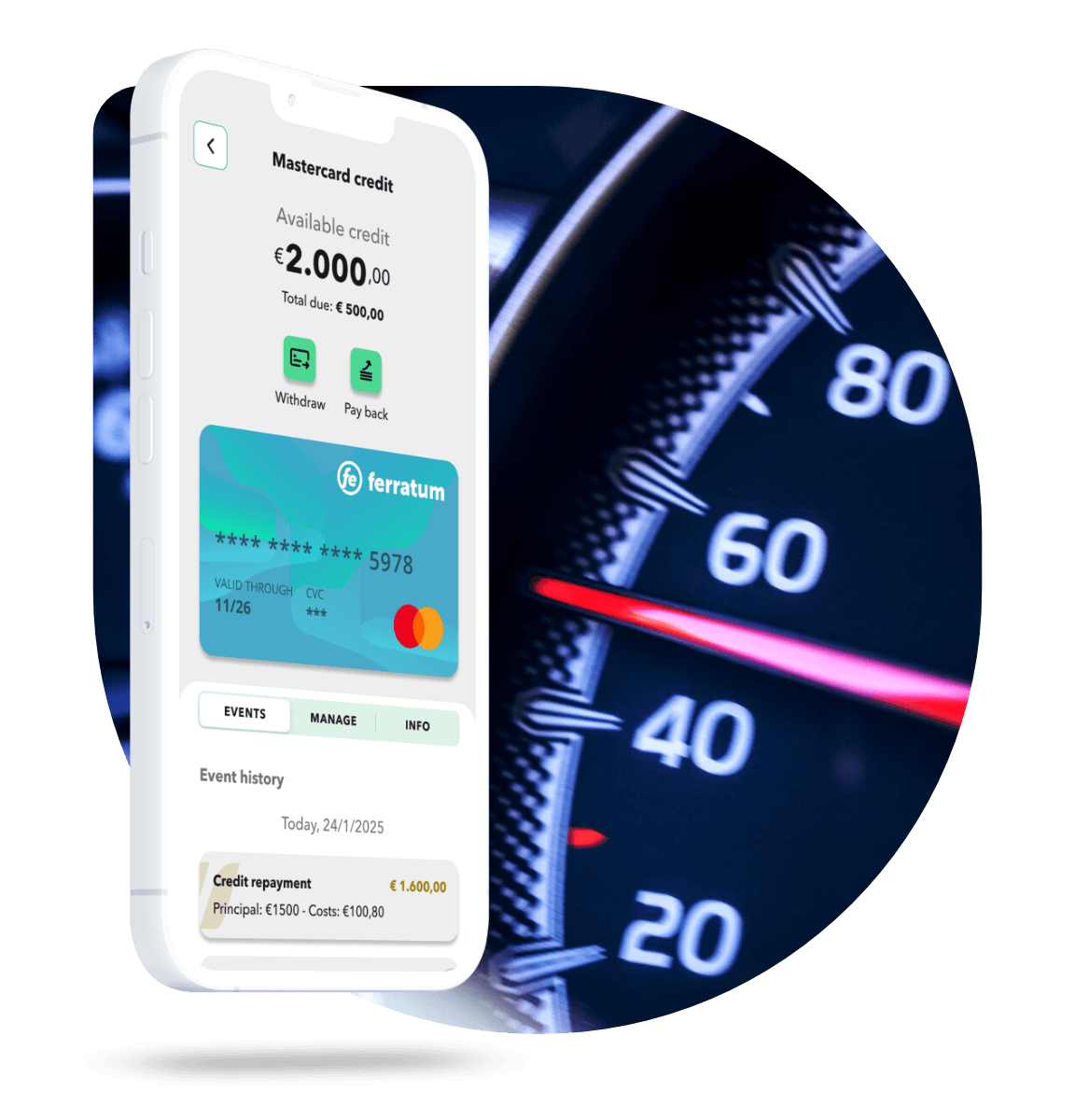

Vehicle loans

Ferratum is here to support you with all your vehicle financing needs, no matter the make or model. From new safety equipment like tires, brakes, and suspension, to urgent repairs or even new vehicle purchases.

Renovation loans

Let Ferratum help you with the financing you need to complete urgent or planned home renovations and repairs. Increase the value of your home or apartment or make your space more enjoyable with our flexible financing.

Wedding loans

Start planning your dream wedding today with up to €8,000 in financing from Ferratum. Purchase everything you need for the big day in store or online at over 30 million merchants. Enjoy up to 60 days on credit purchases using your Ferratum Mastercard, giving you more time to repay without added costs.

Financing in 3

ELIGIBILITY

Who can apply for a credit card

To apply for your Ferratum Mastercard, we ask you to meet these minimum requirements:

-

At least 20 years of age or older

-

Continuous employment for minimum 4 months

-

Earning regular income of 1,600€ per month or greater

-

A good credit standing

Smart banking starts here